1. Do not spend greater than you earn. Debt just isn’t your good friend!

Think about your cash is just like the snacks you’ve got. In the event you eat extra snacks than you’ve got, you may run out, proper? It is the identical with cash. In the event you spend more cash than you even have, you may find yourself owing cash to others, which is named debt. Debt is usually a downside as a result of it’s a must to pay again greater than you borrowed, often with more money referred to as curiosity. So, it is sensible to solely spend what you even have, identical to solely consuming the snacks you’ve got, so you do not find yourself owing greater than you may deal with.

2. By no means ever spend your cash earlier than you’ve got earned and obtained it!

This implies it is best to solely use the cash you have already got in your arms, not the cash you count on to get sooner or later. It is like saying, “Do not rely your chickens earlier than they hatch.” You should not plan to spend cash you have not earned but since you won’t get it, after which you could possibly be in hassle. So, it is safer to solely spend the cash you have earned and really have in your possession.

3. You don’t keep in mattress, until you’re making cash whereas in mattress!

This saying signifies that in case you’re in mattress, you need to be doing one thing productive that earns you cash. It is like saying it is best to solely calm down or relaxation if you’ve already made preparations to earn cash even when you’re resting. So, in case you’re mendacity in mattress, you higher be doing one thing like engaged on a undertaking, finding out, or investing in one thing that can make you cash, slightly than simply idling away your time. It is about being productive and taking advantage of your time to enhance your monetary scenario.

4. Earn cash. Use that cash to earn more money. Rinse and repeat!

First, you make some cash, perhaps via a job or a enterprise.

Then, as an alternative of simply spending all of that cash on belongings you need, you employ a few of it to speculate or begin one thing that may make you much more cash.

After that, if you earn more cash from these investments or ventures, you repeat the method.

So, it is like a cycle: become profitable, use it to earn more money, and preserve doing that over and over to extend your wealth. It is all about utilizing your cash properly to assist it develop slightly than simply spending all of it instantly.

5. The components for monetary success is to rise early, work late and strike oil!

This phrase suggests a components for reaching monetary success.

“Rise early” means waking up early within the morning, which is commonly related to being productive and proactive.

“Work late” means placing in additional effort and dealing exhausting, probably past the standard work hours, to attain your targets.

“Strike oil” is a metaphor for locating one thing helpful or hitting upon a profitable alternative that brings in some huge cash, like discovering oil in your property.

So, the phrase implies that by working exhausting, being diligent, and being open to seizing helpful alternatives, one can obtain monetary success.

6. If you’d like your revenue to develop, then beginning rising!

This phrase means that if you need your revenue to extend, it is best to give attention to private progress and growth. By “beginning rising,” it means investing in your self—studying new expertise, increasing your data, and enhancing your talents. Once you develop your self, you turn out to be extra helpful within the job market or in what you are promoting endeavors. Consequently, you will have extra alternatives for development, higher-paying jobs, or profitable enterprise ventures, finally resulting in a rise in your revenue. So, the thought is that by rising your self, you open doorways to rising your revenue.

7. Simply because you may afford it doesn’t imply you should purchase it!

Having sufficient cash to purchase one thing would not essentially imply it is a good suggestion to buy it. Simply because you’ve got the monetary means would not mechanically make one thing a clever or essential buy. It is about contemplating the worth and significance of what you are shopping for and whether or not it aligns along with your wants, targets, and priorities. So, even in case you can afford one thing, it is clever to consider carefully and take into account whether or not it is really value spending your cash on or if there may be higher makes use of for it. It is all about being aware and making accountable selections along with your funds.

8. In the event you wanna be wealthy, then begin considering of the way to save lots of and investing your revenue!

This assertion suggests a method for turning into rich. It says that if you wish to be wealthy, it is best to give attention to two principal issues: saving cash and investing your revenue.

- Saving cash: This implies being aware of the way you spend your cash and discovering methods to put aside a portion of your revenue for the long run. By saving commonly, you may construct up a monetary security internet and have cash out there for emergencies or alternatives.

- Investing your revenue: Investing entails placing your cash into belongings or ventures with the expectation of incomes a return or revenue. This might embrace investing in shares, actual property, companies, or different alternatives which have the potential to develop your wealth over time.

By combining saving and investing, you may make your cash give you the results you want and probably generate further revenue and wealth. So, the assertion emphasizes the significance of being proactive and strategic along with your funds with a purpose to obtain monetary success and construct wealth over the long run.

9. Small bills are the true disaster. A small leak is bound to sink an incredible ship!

This saying highlights the significance of listening to small bills as a result of they’ll add up and trigger vital monetary issues over time.

- “Small bills are the true disaster”: It signifies that seemingly insignificant or minor bills, when gathered over time, can turn out to be a significant downside on your funds. Whereas large bills may catch your consideration, it is the small ones that may quietly drain your sources with out you realizing it.

- “A small leak is bound to sink an incredible ship”: This can be a metaphor that illustrates how even a tiny leak in a ship’s hull, if left unattended, can result in the ship sinking. Equally, small, ongoing bills, if not managed, can ultimately overwhelm your monetary scenario.

So, the message is to be aware of all of your bills, irrespective of how small they could appear, and to take steps to regulate and decrease them. By doing so, you may forestall them from turning into a monetary disaster that would sink your monetary stability.

10. Motion breeds outcomes. The longer you’re not taking motion the more cash you’re shedding!

This assertion emphasizes the significance of taking motion to attain outcomes, particularly on the subject of being profitable.

- “Motion breeds outcomes”: It signifies that by taking motion, you are extra more likely to see constructive outcomes or obtain your targets. With out motion, there are not any outcomes. So, if you wish to see progress or success, it’s essential take proactive steps in the direction of it.

- “The longer you’re not taking motion the more cash you’re shedding”: This implies that procrastination or inaction will be pricey, significantly when it comes to missed alternatives. Once you delay taking motion, it’s possible you’ll be lacking out on possibilities to earn cash or enhance your monetary scenario. Over time, these missed alternatives can add up, leading to potential losses or setbacks.

So, the assertion encourages being proactive and taking motion in the direction of your monetary targets, as ready or hesitating can finally result in missed alternatives and misplaced revenue.

11. By no means be that one that begs for that which you’ve got the ability to earn!

This assertion emphasizes self-reliance and the significance of taking duty on your personal success slightly than counting on others for handouts or favors.

- “By no means be that one that begs”: It means that it isn’t admirable or respectable to always ask or beg for issues that you could possibly obtain via your individual efforts. Begging implies an absence of initiative and self-sufficiency.

- “For that which you’ve got the ability to earn”: This half highlights the concept that as an alternative of counting on others, it is best to acknowledge your individual talents and potential to earn what you want or need. It is about harnessing your expertise, sources, and willpower to create alternatives and obtain your targets.

So, the assertion encourages people to take possession of their lives and try to earn what they want via exhausting work, perseverance, and self-reliance, slightly than counting on handouts or favors from others.

12. By no means ever let cash run your life, let cash enable you run your life higher!

This saying suggests a wholesome perspective on the function of cash in a single’s life.

- “By no means ever let cash run your life”: This half emphasizes that cash should not be the only driving power or figuring out consider your selections and actions. It is a warning towards permitting monetary considerations to dominate your life to the purpose the place it dictates your each transfer or resolution.

- “Let cash enable you run your life higher”: This highlights the concept that whereas cash is necessary, it ought to function a software to enhance your life slightly than management it. Cash can present alternatives, safety, and luxury, nevertheless it’s how you employ it that issues. By managing your funds properly and aligning your spending along with your values and priorities, you may leverage cash to reinforce your life and obtain your targets.

General, the saying encourages a balanced method to cash, the place it’s considered as a method to an finish slightly than the tip itself. It suggests utilizing cash as a software to help and improve your life, slightly than permitting it to dictate your happiness or outline your value.

13. You solely have so many hours in a day, now let belongings and others make the cash for you!

This assertion underscores the idea of leveraging your time and sources to generate revenue extra effectively.

- “You solely have so many hours in a day”: This acknowledges the finite nature of time. No matter how exhausting you’re employed, there is a restrict to the variety of hours out there in a day to earn cash via lively labor.

- “Now let belongings and others make the cash for you”: This implies a shift in focus from relying solely by yourself labor to generate revenue, to using belongings (reminiscent of investments, companies, or actual property) and delegating duties to others (reminiscent of staff or companions) to create passive revenue streams.

By investing in belongings that generate revenue independently of your direct involvement and by delegating duties to others, you may multiply your incomes potential past what you could possibly obtain via your individual efforts alone. This method permits you to profit from your restricted time and sources, finally working smarter, not simply more durable, to construct wealth.

14. Be clever sufficient to maintain cash in your head and thoughts, not in your coronary heart and feelings!

This saying emphasizes the significance of sustaining a rational and strategic method to dealing with cash, slightly than letting feelings or impulses dictate monetary selections.

- “Be clever sufficient to maintain cash in your head and thoughts”: Because of this on the subject of cash issues, it is necessary to make use of logic, motive, and cautious consideration. As an alternative of letting feelings information monetary selections, one ought to depend on rational considering, data, and planning.

- “Not in your coronary heart and feelings”: This implies that feelings like greed, worry, or impulsiveness can cloud judgment and result in poor monetary selections. When cash selections are pushed by feelings, they could not align with long-term targets or monetary well-being.

By preserving cash administration rooted in logic and mindfulness, people could make extra knowledgeable and useful monetary selections. It is about being conscious of the emotional elements that may affect monetary habits and consciously selecting to prioritize rationality and prudence in managing cash.

In the event you can grasp these 14 guidelines, you may be nicely in your approach to profitable the cash recreation.

Written by- https://x.com/DividendIncome_

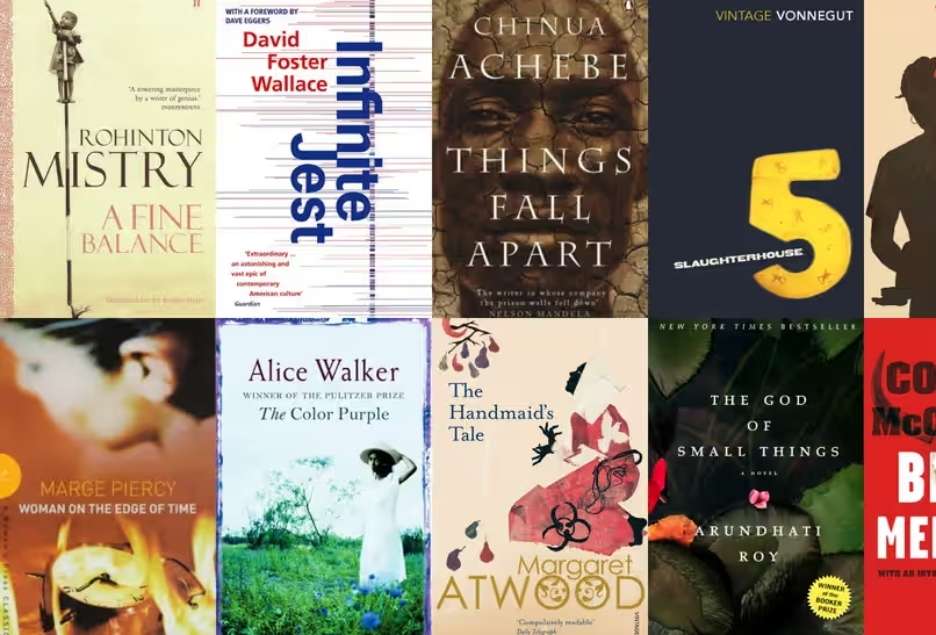

You additionally may like: 5 Wonderful Books to Grasp Your Cash!